Houston area refiners weather hurricane-force winds

Over 2mn b/d of US refining capacity faced destructive winds Thursday evening as a major storm blew through Houston, Texas, but the damage reported so far has been minimal.

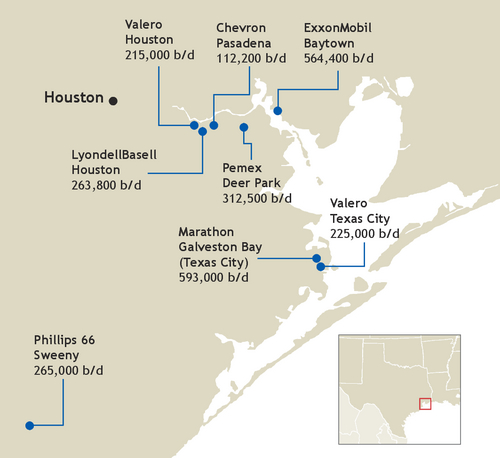

Wind speeds of up to 78 Mph were recorded in northeast Houston and the Houston Ship Channel — home to five refineries with a combined 1.5mn b/d of capacity — faced winds up to 74 Mph, according to the National Weather Service.

Further South in Galveston Bay, where Valero and Marathon Petroleum refineries total 818,000 b/d of capacity, max wind speeds of 51 Mph were recorded.

Chevron's 112,000 b/d Pasadena refinery on the Ship Channel just east of downtown Houston sustained minor damage during the storm and continues to supply customers, the company said.

ExxonMobil's 564,000 b/d Baytown refinery on the Ship Channel and 369,000 b/d Beaumont, Texas, refinery further east faced no significant impact from the storm and the company continues to supply customers, a spokesperson told Argus.

Neither Phillips 66's 265,000 b/d Sweeny refinery southwest of Houston nor its 264,000 b/d Lake Charles refinery 140 miles east in Louisiana were affected by the storm, a spokesperson said.

There was no damage at Motiva's 626,000 b/d Port Arthur, Texas, refinery according to the company.

Marathon Petroleum declined to comment on operations at its 593,000 b/d Galveston Bay refinery.

Valero, LyondellBasell, Pemex, Total, Calcasieu and Citgo did not immediately respond to requests for comment on operations at their refineries in the Houston area, Port Arthur and Lake Charles.

A roughly eight-mile portion of the Houston Ship Channel from the Sidney Sherman Bridge to Greens Bayou closed from 9pm ET 16 May to 1am ET today when two ships brokeaway from their moorings, and officials looked in a potential fuel oil spill, according to the US Coast Guard.

The portion that closed provides access to Valero's 215,000 b/d Houston refinery, LyondellBasell's 264,000 b/d Houston refinery and Chevron's Pasadena refinery.

Related news posts

Dangote jet fuel weighing on European prices

Dangote jet fuel weighing on European prices

London, 31 May (Argus) — Jet fuels cargoes heading to Europe from Nigeria's new 650,000 b/d Dangote refinery are putting downward pressure on regional prices, according to market participants. A BP-purchased cargo was loaded on the Doric Breeze on 25 May at the Dangote refinery, according to sources and ship tracking provider Kpler. The latter said the cargo 45,000t, with an arrival date of 11 June at Rotterdam. BP won a Dangote tender for three jet cargoes totalling 120,000t, according to sources, and Spain's Cepsa has bought one cargo for loading in early June. Refining premiums against North Sea Dated for jet cargoes delivered to northwest Europe have dropped by $3.31/bl this week to a three-week low of $19.72/bl, as participants expect the additional supply from Nigeria to sufficiently cover the summer uplift in air travel demand. Dangote started producing what it called aviation fuel for the Nigerian market in January. A sample dated 26 May seen by Argus shows the jet fuel offered from Dangote now probably meets standard European specification A-1. The test contained 254ppm of sulphur, far below the maximum 0.3pc content in jet A-1, and its freezing point was -57ºC, stricter than the European specification of maximum -47ºC. Weaker margins on jet could prompt refineries towards regrade possibilities for other middle distillates, primarily diesel, traders said. Jet fuel has been at a significant premium over diesel in northwest Europe for the past month, thanks to better demand. But these have weakened by more than half this week, to just $1.10/bl on 30 May from $2.50/bl at the start of the week. Dangote expects to begin exports of European-standard diesel in June . By Olivia Young and George Maher-Bonnett Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Aramco looks to woo global investors with share sale

Aramco looks to woo global investors with share sale

Dubai, 31 May (Argus) — The rationale for state-controlled Saudi Aramco's decision to launch a secondary public offering is not only to provide funds to the Saudi government for its massive socio-economic transformation plan but also to broaden the company's shareholder base among local and international investors, chief executive Amin Nasser said. Aramco revealed yesterday that it plans to sell 1.545bn shares, equivalent to about 0.64pc of the company, in a secondary public offering due to kick off on 2 June. The shares are expected to be priced in a range of 26.70-29 Saudi riyals ($7.12-$7.73) each, which means the firm could raise $12bn at the top end. Proceeds could be as high as $13.1bn at the top end of the range if Aramco chooses to exercise an over-allotment option, which would allow the sale of around 1.7bn shares. Aramco's closing share price on 30 May stood at SR29. "The offering provides us with an opportunity to broaden the shareholder base among both Saudi and international investors," Nasser said. "It also offers us an opportunity to further increase liquidity and to increase global index weighting." The offering has been years in the making. Aramco's initial public offering (IPO) in 2019 raised a record $29.4bn. The secondary offering will test international investment appetite for fossil fuels in the face of growing concerns over global climate targets. Nasser points to four key performance-related reasons as to why he views Aramco as an attractive investment opportunity. The first is the company's competitive advantage due to scale, cost efficiency and low upstream carbon intensity. The second is Aramco's differentiated growth opportunities across upstream, downstream, carbon capture, hydrogen and renewables. The third is its financial strength and the fourth its dividend distribution policy. "We distributed a record $98bn in 2023 and we anticipate distributing over $124bn of dividends in 2024. This would represent an almost 30pc increase from 2023," Nasser said. Proceeds from the offering will help fund Saudi Arabia's Vision 2030 initiative, a government programme which aims to achieve increased diversification economically, socially and culturally. Saudi Arabia's finance minister Mohammed al-Jadaan suggested last month that the country may make changes to its plans, including delays or acceleration for some projects. Saudi Arabia recorded a sixth straight quarterly budget deficit in January-March this year, as spending outpaced revenue on the back of lower energy prices and curbs on its crude production. The launch of the secondary offering on 2 June coincides with an Opec+ ministers' meeting to decide whether to extend the group's current voluntary crude supply cuts into the second half of the year. By Bachar Halabi Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Opec+ heads for supply cut rollover

Opec+ heads for supply cut rollover

Dubai, 31 May (Argus) — Opec+ ministers look increasingly likely to agree to extend the group's current crude oil supply cuts into the second half of the year when they meet virtually on 2 June. But as ever, when it comes to this iteration of Opec+, an added surprise should never be ruled out. Opec and its non-Opec partners head into this weekend's meetings facing plenty of uncertainty, not only around supply-demand fundamentals but also the macroeconomic outlook. While some green shoots for the global economy are appearing ꟷ signs of stronger-than-expected growth in China and the Eurozone tentatively exiting recession in the first quarter ꟷ data out of the US remain a point of concern, with the Federal Reserve continuing to signal the need to reinforce restrictive monetary policies. The uncertainty, coupled with geopolitical tensions, has contributed to erratic movement in oil prices over the past couple of months. Ice Brent futures breached the $90/bl mark in early April, up more than 10pc on the month, only to shed most of those gains in the weeks that followed. The front-month Ice Brent contract has been oscillating between $82/bl and $84/bl since the middle of May. Effectively, the only thing up for debate at the weekend meetings ꟷ one involving Opec ministers, another involving the wider Opec+ coalition and a third consisting of the Joint Ministerial Monitoring Committee (JMMC) ꟷ is the fate of the 2.2mn b/d "voluntary" supply cut that eight member countries, led by Saudi Arabia and Russia, committed to in late November. It was originally due to last for just three months but was later extended for another three months until the end of June . When oil prices were climbing in early April, in the face of tightening fundamentals and rising geopolitical tensions, expectations were high that the group would begin to unwind at least part of the 2.2mn b/d cut from July. But a growing consensus that tensions in the Middle East were unlikely to threaten supply, coupled with signs that the Fed and other major central banks may hold off on loosening monetary policy, brought with it a softening in oil prices and a change in sentiment among Opec+ delegates about what lies next. Delegates now argue that the market does not need an injection of additional supply, particularly in light of the uncertain outlook for oil demand in the second half of 2024. "The oil market is well supplied," one delegate said. "Some producers are facing difficulties to clear their May and June programmes." A second delegate described the outlook for oil demand as "highly uncertain", while a third conceded "it is unclear to what extent oil demand will actually pick up in the second half". Three other delegates said they expect the eight countries to agree an extension of current cuts, although it remains unclear whether it will be for three months, to the end of the year or maybe even longer. "A rollover would be most logical," one said. Although not an immediate priority, discussions will also be taking place about how the cuts should eventually be unwound. Restoring supply will most likely be spread out, possibly over a long period of time, so as not to spook the market, delegates said. Surprise, surprise Last week's announcement that the upcoming meetings will be held online, rather than in person in Vienna, adds support to the assumption that an extension of the cuts is the most likely outcome. But with oil prices edging towards the lower $80s/bl, more than one delegate has suggested that some of the eight member countries making voluntary reductions could spring a surprise in the form of deeper cuts. This would not be without precedent. Saudi Arabia pledged its voluntary 1mn b/d cut, dubbed a "lollipop" by Saudi energy minister Prince Abdulaziz bin Salman, immediately after the June 2023 Opec+ meeting. By Nader Itayim, Bachar Halabi and Aydin Calik Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Trump found guilty in criminal 'hush money' case

Trump found guilty in criminal 'hush money' case

Washington, 30 May (Argus) — Former president Donald Trump was found guilty today on 34 felony counts of falsifying business records in relation to the reimbursement of a $130,000 payment to an adult film star ahead of the 2016 presidential election. The unanimous guilty verdict, from a 12-member jury in New York, will inject further uncertainty into the presidential election on 5 November, where Trump is the presumed Republican nominee and is leading in many polls against President Joe Biden. Trump is the first former US president to face a criminal trial, and his conviction means he will run for office — on a campaign focused in part on rolling back energy sector regulations and expanding drilling — as a convicted felon. Sentencing is scheduled for 11 July. Trump has argued the criminal charges, filed by New York state prosecutors, were "ridiculous" and were a politically motivated attempt to interfere with his campaign. At trial, Trump's attorneys argued against the credibility of a key witness, Trump's former attorney Michael Cohen, who testified that Trump directed the falsification of the business records to conceal a "hush money" payment to the adult film star following an alleged affair. "This was a rigged, disgraceful trial," Trump said following the verdict, "but the real verdict is going to be November 5 by the people, and they know what happened here." Despite the conviction, Trump, if elected, could still serve as president. Trump could face up to four years in prison, and sentencing will be decided by the judge overseeing the case. Trump is separately facing dozens of other felony charges in federal and Georgia state court, but those cases have faced delays and may not go to trial before the election. President Joe Biden's campaign said Trump has "always mistakenly believed" he would not face consequences. Biden's campaign said that despite the verdict, it would be up to voters to decide whether Trump is re-elected. "Convicted felon or not, Trump will be the Republican nominee for president," Biden's campaign said. By Chris Knight Send comments and request more information at feedback@argusmedia.com Copyright © 2024. Argus Media group . All rights reserved.

Business intelligence reports

Get concise, trustworthy and unbiased analysis of the latest trends and developments in oil and energy markets. These reports are specially created for decision makers who don’t have time to track markets day-by-day, minute-by-minute.

Learn more